colorado electric vehicle tax rebate

The Colorado Energy Office has partnered with ChargePoint to build EV fast-charging stations along the states major transportation corridors. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

Tax Credits Drive Electric Northern Colorado

Colorado to stop sales tax on diapers and menstrual products The state estimates the legislation will save Coloradans a combined 91 million annually.

. Colorado DMV State Fees. EV owners interested in charging up faster can consider installing a Level 2 charger at their home. The stations will be located in communities at 34 sites across six Colorado corridors - and several locations are now open.

3 Ford Mustang Mach-E sold just 27140. EV buyers can choose to transfer the amount of the applicable tax credit to the car dealer who can then apply the rebate at the time of purchase amount as a discount off the purchase price or down payment. Writing for Reason Joe Lancaster noted that President Joe Bidens initial Build Back Better proposal included a tax credit that would have applied to all of one vehicle the Chevrolet Bolt.

Maine offers electric vehicle tax rebates that vary based on your income level and whether the vehicle is all-electric plug-in and new or used. Therefore the taxable amount is 35000. The IRA adds a.

Historical Commission Corner - August 2022. You can buy or lease a new or used EV from any Colorado-based car dealer. Follow the link to read more.

The Inflation Reduction Act includes tax credits of 7500 for new EVs plus 4000 for used EVs and partial credits for hybrid vehicles. Note the tax credit phases out over 5 quarters The addition of a 4000 creditrebate for used EVs. Innovative Motor Vehicle and Truck Credits for Electric and Plug-in Hybrid Electric Vehicles - FYI Income 69 Innovative Truck Credits for Tax Years 2017 and Later - FYI Income 70 Investment Credits for Licensed Child Care Centers Family Care Homes and Employers Providing Licensed Child Care Facilities - FYI Income 7.

The standard rebate is. In Connecticut 3000 and Delaware 3500 the incentives are rebates and can be deducted from the price of the vehicle regardless of taxes owed. That alone would take the LEAF price down almost equal to.

Applicants that certify as low income will be given priority in disbursement of the rebates. Level 1 charging cables can take a while if you own an electric vehicle. Thats in addition to the federal tax credit and the tandem can reduce the effective out-of.

Consumer Reports found in 2020 that electric vehicles can cost between 10 and 40 percent more than other similar vehicles. However in Colorado which offers the highest incentive 5000 on top of the federal credit youd have to owe 12500 in taxes to claim the full amount. If two bills in two years have proposed electric vehicle rebate programs that would apply to virtually no cars.

On the total weight of the vehicle. For context the No. Denver meanwhile said it plans to announce a new round of e-bike assistance after the Fourth of July.

You can get a rebate on any new or used plug-in electric vehicle battery electric or plug-in hybrid electric with a manufacturers suggested retail price for a new EV or the final negotiated price for a pre-owned EV of 50000 or less. The retailer must list the fee as a separate item called retail delivery fees on the receipt or invoice issued to the purchaser. Local and Utility Incentives.

Tax Credits Rebates Savings Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates. Find more info and a map of locations here. After July 1 2023 Maryland residents who purchase a qualified electric vehicle or fuel cell electric vehicle can receive an excise tax credit of.

An eligible vehicle must. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. What was it like for automobile travel in our area before US 36 came into existence.

Now not one single vehicle qualifies for the full rebate he wrote. It also earmarks money to promote energy efficiency retire polluting power plants and support communities disproportionately affected by pollution and climate change. The Tesla Model Y sold 172700 units in 2021 according to Car and Driver.

Electric Vehicles Solar and Energy Storage. But the reports noted that consumers typically save between 6000 and. You still have to pay a sales tax on the 2500 rebate.

However the Department currently has no plans to prioritize enforcement of this provision as long as retailers are paying the full amount of the fees due in accordance with their liability under section 43-4-6056c CRS. Colorado dealerships may charge the. The Arkansas Department of Environmental Qualitys ADEQ Level 2 EVSE Rebate program offers rebates of up to 9300 depending on applicant type to government private and non-profit entities for the construction and installation costs of Level 2 EVSE.

Vehicles from 2001 pounds to 4500 pounds. A few states like Colorado offered purchase incentives for used electric cars but there was no federal incentive until now. The Model 3 sold 128600.

Arkansas Electric Vehicle Supply Equipment EVSE Grants ADEQ State EV Charging Incentive. Electric Vehicle EV Rebate Program. Be a four-wheeled motor vehicle manufactured for use on public streets roads and highways.

The EV Charging Home Wiring Rebate provides up to 1000 to assist with installing either an Energy Star Certified Level 2 EV Charger or a home Tesla charger. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. The New York State Energy Research and Development Authority NYSERDA provides rebates of up to 2000 for the purchase or lease of a new eligible EV.

The Illinois EPAs Electric Vehicle Rebate Program application opened on July 1 2022I llinois residents purchasing a new or used all-electric passenger vehicle or all-electric motorcycle from an Illinois licensed dealer are now eligible for the rebate. Colorado officials are detailing plans to give out 12 million in statewide electric bike rebates approved by this years legislature following on the wild success of a Denver e-bike assistance plan that maxed out its first round of 3250 applications in a matter of weeks. The IRA will achieve this through tax credits and rebates for various renewable technologies such as solar panels heat pumps and electric vehicles.

In California for example people who buy or lease a new electric car can get a 750 cash rebate.

Zero Emission Vehicle Tax Credits Colorado Energy Office

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Electric Vehicles In Centennial City Of Centennial

Tax Credits De Co Drive Electric Colorado

2023 Chevy Colorado Will Debut In Zr2 Off Road Form July 28 In 2022 Chevrolet Colorado Chevy Colorado Chevrolet

Buy An Electric Car And Save Bankrate

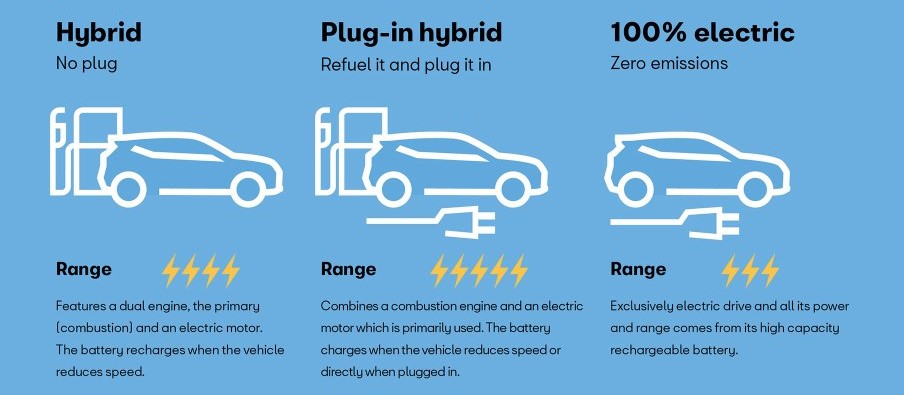

All About Electric Vehicles De Co Drive Electric Colorado

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

/cloudfront-us-east-2.images.arcpublishing.com/reuters/43L4KKPDZFPS7AEGULKUZGRNT4.jpg)

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

States Used To Help People Buy Electric Cars Now They Punish Them For It Electric Cars Hybrid Car Electric Car Conversion

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

How Do Electric Car Tax Credits Work Credit Karma

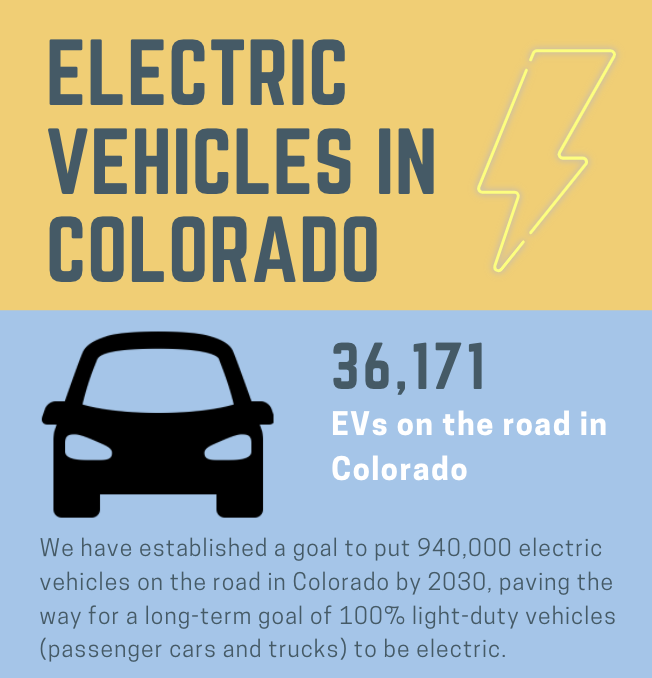

Electric Vehicles In Colorado Report May 2021

Creating The Sustainable Electric Vehicle Revolution

Electric Vehicle Tax Credits After The Inflation Reduction Act What S New

A Complete Guide To The Electric Vehicle Tax Credit

Are Michigan S Registration Fees On Electric Vehicles Causing It To Fall Behind Other States

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore